Recent Posts

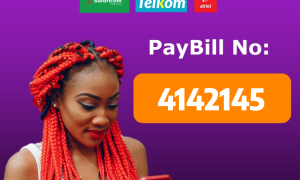

TeelPay makes it convenient to buy airtime for all networks in Kenya. Simply use 4142145, the official PayBill Number to buy airtime for Safaricom, Airtel and Telkom for free. However, for airtime more than 100, MPESA transaction charges apply. Go to the Lipa Na M-PESA optionSelect PayBill optionEnter the business number, 4142145Enter your phone number as the account numberEnter the airtime amount you want to buyEnter your M-PESA PIN and confirm the transactionYou will receive a confirmation message from M-PESA plus a message from the network you are buying airtime for with details of the amount of airtime bought.

The official PayBill number for TeelPay is 4142145. You can

use this PayBill number to buy airtime for all networks from M-PESA.How to use the PayBill numberGo to the Lipa Na M-PESA optionSelect PayBill optionEnter the business number, 4142145Enter your phone number as the account numberEnter the airtime amount you want to buyEnter your M-PESA PIN and confirm the transaction

You will receive a confirmation text from M-PESA immediately

plus a text from the network you are buying airtime for with details of the

amount credited.

Buying airtime for all network has never been easy thanks to

several innovative solutions. TeelPay offers innovative solutions to

conveniently buy airtime for all networks from Safaricom to Airtel and Telkom.

Use the official PayBill number 4142145 to buy Airtel and Telkom airtime of any

amount. However, you’ll be charged for airtime amounts exceeding KES 100. Step by Step Guide to Buying Airtel Airtime from M-PESA for

FreeGo to M-PESA menu and select Lipa Na M-pesaSelect PayBill option Enter PayBill number 4142145, the official PayBill to buy

Airtel airtime Enter the airtime amount you would like to purchase. To buy

Airtel and Telkom airtime amount without charges, enter amounts between 5 and

100. Enter your Airtel or Telkom number as the account numberEnter your M-PESA PIN to authorize transaction

Wait for text message from M-PESA and Airtel or Telkom to

ensure complete transaction and your airtime amount is credited to your airtime

account.

The telecommunication industry in Kenya has evolved to

greater extent from text messaging to voice calls. Service providers always

develop innovative solutions to make it easier for subscribers to stay

connected. This includes buying talk-time tokens known as airtime. M-PESA is

one of the innovative ways subscribers conveniently buy airtime without

physical exchange of currency. This article outlines step-by-step guide to

buying Airtel airtime from their M-PESA accounts. Step 1:Open M-PESA menu in the safaricom toolkit or using

the M-PESA app installed on your phoneStep 2: Choose Lipa Na M-Pesa option that allows users to

pay for goods and servicesStep3: Choose PayBill optionStep4: Enter the PayBill number 4142145, the official number

for buying Airtel airtimeStep5: Enter your Airtel number as your account number.

Double check the number to ensure you do not make a mistake and buy airtime for

a wrong numberStep6: Enter the amount for the airtime bundle you would

like to purchase. However, M-PESA only allows free purchases for amounts less

than KES 100. Step7: Enter your secret PIN to authorize payment

Step8: Wait for confirmation from M-PESA to ensure complete

transaction. You will also receive a text message from Airtel to confirm

airtime has been credited to your account.

The telecommunication space in Kenya has grown since

independence from home telephones to mobile phones or handsets. The

communication space is regulated by the Communications Authority (CA) that

ensures the space is used in a way that does not cause harm to others. With the

evolution of handsets, Kenya had an increasing demand for communication services

such as data and talk time bundles. According to September 2019 data, Kenya had

about 53.2 million subscribers with major players such as Safaricom and Airtel

taking the highest percentage of subscriptions. For example, Safaricom has

grown to having about 34.5 million subscribers while Airtel had about 13.1

million subscriptions, according to the 2019 data. The numbers continue to grow

with increasing reach to customers by Safaricom and Airtel.The major players, Safaricom and Airtel due to stiff

communication, develop innovative solutions to attract subscribers their way. For

example, M-PESA services provided by Safaricom has had a major impact on

subscribers choosing Safaricom over the competitor. The financial product is

used by about 27.6 million Kenyans to send and receive money from any part of

the county. It offers several services including purchasing talk time bundles

also known as airtime. M-PESA allows customers to buy airtime via their phones

without needing physical scratch cards. However, the services do not allow

customers to purchase airtime for other networks. To find a solution to this,

mobile operators developed an indirect way using PayBill which is issued by the

service provider.Using PayBill to Purchase AirtimeTeelPay provides an innovative solution to buy airtime to

other networks including Airtel and Telkom. Using the official PayBill number

4142145, you can easily purchase airtime of any amount via M-PESA. However, the

services is free for airtime amounts less than KES 100. This is convenient to

the majority of Kenyans who purchase less than KES 100 airtime amount. Follow these steps to buy airtime for all networks:Go to M-PESA menuSelect PayBill optionEnter business number 4142145Enter the number you wish to purchase airtime forEnter the airtime amountEnter your secret PIN to confirm payment

In today's interconnected world, sending money internationally is more common than ever. Whether you're supporting family abroad, paying a remote contractor, or splitting a vacation bill with friends, there are numerous ways to get your funds where they need to go. This article explores the different methods available for sending money globally, helping you choose the best option for your needs.Banks and Wire TransfersBanks have long facilitated international money transfers, often using a system called SWIFT. While secure and reliable, bank transfers can be slow and expensive. They typically incur high fees, and exchange rates might not be the most competitive.Online Money Transfer A new breed of online money transfer services has emerged, offering a faster and more cost-effective alternative to traditional banks. TeelPay offers online money transfer services, leveraging technology to streamline the process. They often boast lower fees, transparent exchange rates displayed upfront, and the convenience of online or mobile app transfers.Factors to consider when choosing the Right ServiceFees: Compare transfer fees between services, including any hidden costs.Exchange Rates: Look for services offering competitive exchange rates to maximize the amount received by your recipient.Speed: Consider whether you need the transfer to arrive instantly or if a slower, cheaper option suffices.Delivery Method: Will the recipient receive the money in their bank account, for cash pickup, or as mobile wallet credit? Choose a service that aligns with their needs.Additional ConsiderationsTransfer Limits: Some services have limitations on the amount you can send in a single transaction.Security: Ensure the service uses robust security measures to protect your financial information.The Bottom LineSending money internationally doesn't have to be a hassle. By considering the factors mentioned above, choose TeelPay money transfer as it offers a safe, fast, and cost-effective way to get your funds where they need to go. With a little research, you can choose the perfect money transfer service for your next global transaction.

When you've received money into your PayPal account, you'll need to withdraw to your local bank account. TeelPay provides a relatively fast and easy way to do so. Just have your PayPal account set up and sign up with us for cheap transfer.

Financial wellness isn't just about how much money you make; it's about how you manage it. For many, navigating personal finance can feel overwhelming. But fret not! By taking some simple steps, you can establish healthy money habits and achieve your financial goals.1. Know Where You Stand: The first step is gaining a clear understanding of your current financial situation. Track your income and expenses for a month. Categorize your spending to identify areas where you might be able to cut back. Many budgeting apps and online tools can simplify this process.2. Craft a Budget: Once you understand your spending patterns, create a realistic budget. A popular method is the 50/30/20 rule, where 50% goes towards needs (rent, groceries), 30% for wants (entertainment, dining out), and 20% towards savings and debt repayment.3. Set SMART Goals: Having financial goals will keep you motivated. Set Specific, Measurable, Attainable, Relevant, and Time-bound goals. Do you want to save for a down payment on a house in two years? This will influence how much you need to set aside each month.4. Automate Your Finances: Set up automatic transfers to savings and bill payments to avoid late fees and ensure you stay on track with your budget.5. Tame the Debt: High-interest debt can derail your financial progress. Prioritize paying off credit cards with the highest interest rates first. Consider strategies like the debt snowball or avalanche to make progress.6. Build Your Savings: A healthy emergency fund can prevent financial hardship during unexpected events. Aim to save 3-6 months of living expenses.7. Invest for the Future: Once you have a handle on your debts and emergency savings, consider investing for your long-term goals, like retirement.8. Review and Revise: Your financial situation will change over time. Regularly review your budget and adjust your goals and strategies as needed.Financial management is a journey, not a destination. Be patient, be persistent, and celebrate your milestones along the way. With a little effort, you can take control of your finances and build a secure financial future.