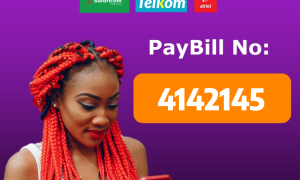

Buy Safaricom, Airtel and Telkom Airtime for Free Through Safaricom PayBill

04/17/2025

Financial wellness isn't just about how much money you make; it's about how you manage it. For many, navigating personal finance can feel overwhelming. But fret not! By taking some simple steps, you can establish healthy money habits and achieve your financial goals.

1. Know Where You Stand: The first step is gaining a clear understanding of your current financial situation. Track your income and expenses for a month. Categorize your spending to identify areas where you might be able to cut back. Many budgeting apps and online tools can simplify this process.

2. Craft a Budget: Once you understand your spending patterns, create a realistic budget. A popular method is the 50/30/20 rule, where 50% goes towards needs (rent, groceries), 30% for wants (entertainment, dining out), and 20% towards savings and debt repayment.

3. Set SMART Goals: Having financial goals will keep you motivated. Set Specific, Measurable, Attainable, Relevant, and Time-bound goals. Do you want to save for a down payment on a house in two years? This will influence how much you need to set aside each month.

4. Automate Your Finances: Set up automatic transfers to savings and bill payments to avoid late fees and ensure you stay on track with your budget.

5. Tame the Debt: High-interest debt can derail your financial progress. Prioritize paying off credit cards with the highest interest rates first. Consider strategies like the debt snowball or avalanche to make progress.

6. Build Your Savings: A healthy emergency fund can prevent financial hardship during unexpected events. Aim to save 3-6 months of living expenses.

7. Invest for the Future: Once you have a handle on your debts and emergency savings, consider investing for your long-term goals, like retirement.

8. Review and Revise: Your financial situation will change over time. Regularly review your budget and adjust your goals and strategies as needed.

Financial management is a journey, not a destination. Be patient, be persistent, and celebrate your milestones along the way. With a little effort, you can take control of your finances and build a secure financial future.

Latest Posts

-

02/28/2025